epf i akaun investment

Select your preferred FMI and complete your. Meanwhile members aged 55 and above can utilise i-Invest using Akaun 55 or Akaun Emas.

General Information Epf I Invest Via I Akaun Principal Asset Management

Frequently Asked Question FAQ i-Akaun Member Login USER ID.

. EPF i-Invest is Employees Provident Fund EPFs self-service online transaction platform which allows eligible EPF members with EPF i-Akaun to invest in EPF-qualified unit trust funds with their savings from EPF Account 1. Minimum investment is RM1000. A lot of Malaysians have 60 70 of their assets lock in EPF.

Who Can Apply Requirements Malaysians OR Permanent Residents PR OR. Invest in 4 simple steps. EPF i-Invest Programme Message to Investors Invest Your EPF digitally with Principal Asset Management via FinAIMS Lee Chin at 0 sales charge and enjoy portfolio management by Lee Chin.

22 rows No upfront fees will be imposed by FMI for investments transacted through i-Invest via EPF i-Akaun while for investments made through agents the upfront fee will be reduced from a maximum of 3 to a maximum of 15. Log in to EPF i-Akaun. I-Invest - Employees Provident Fund.

Enter your investment amount complete your transaction. The evaluation will in turn assist members in making informed investment choices that correspond to their risk appetites. EPF i-Invest Programme Message to Investors Invest Your EPF digitally with Principal Asset Management via FinAIMS Amelia Hong at 0 sales charge Invest for FREE It used to be 3 now is 0.

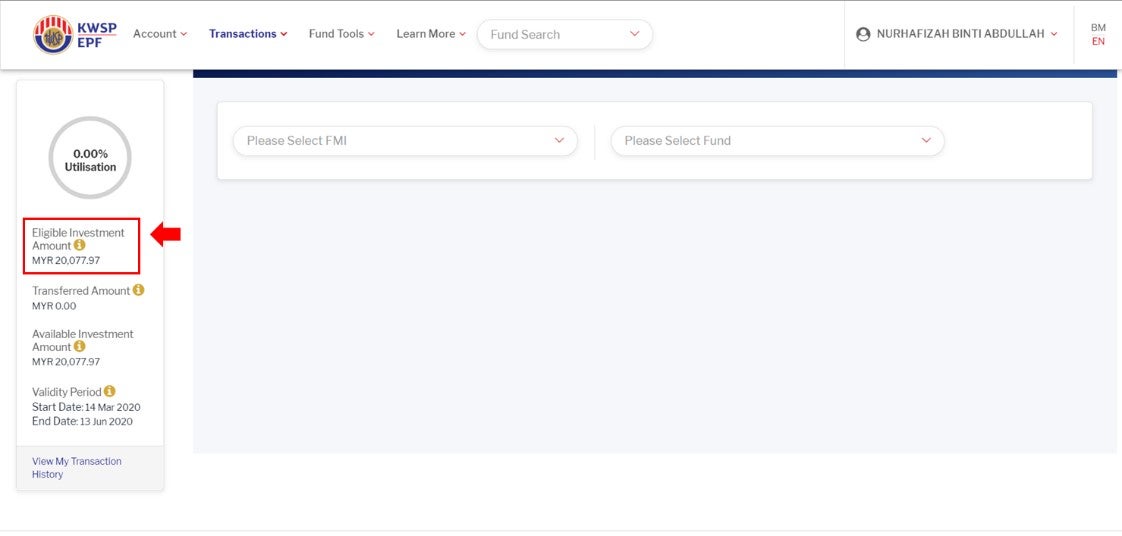

The total amount eligible to invest in unit trust funds approved by EPF. Eligible Employees Provident Fund EPF members are now able to invest their EPF savings into unit trust funds from approved Fund Management Institutions FMIs directly from the EPF i-Akaun portal. EPFs i-Invest in 4 simple steps.

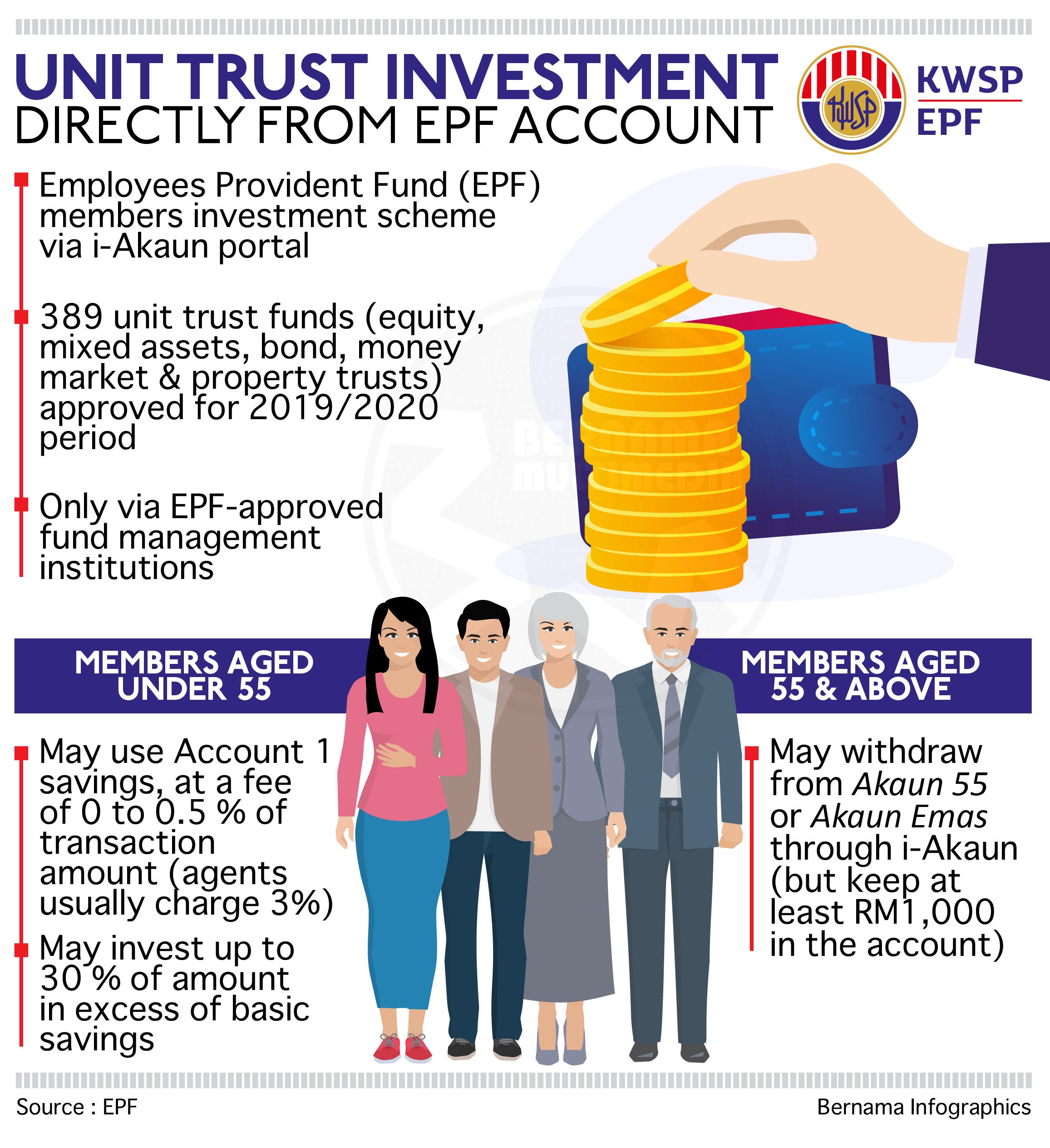

Log in to your EPF i-Akaun. This is additional bonus because did you know that you dont have to go to the branch to get an EPF statement. A key element of the online investment facility according to Tunku Alizakri was that sales charges were now practically free as the EPF has enforced a maximum cap of 05 per cent compared to the current 3 per cent for offline and traditional transactions through agents.

Members can monitor their investment funds through their i-Akaun and look up information on cost of investment historical performance as well as required statutory information. What are the benefits of investing via EPF i-Invest. Members may transfer from their EPF Account 1 up to 30 of the amount in excess of Basic Savings to be invested in the qualified funds.

Called i-Invest this new platform addresses the biggest pain point of EPF members who wish to invest their EPF Account 1 savings into unit trusts. Requirements Malaysians i-Akaun Member user Have a balance in EPF account Types of Protection Offered Life protection Critical illness protection Key Features of i-Lindung Seamless journey The simplest way to purchase protection products with no medical check-up required Quick quotation Get a quotation online for all products offered. Invest for FREE It used to be 3 now is 0.

How do you calculate unit trust. Use my consultant code 00024113 when you invest and you will get a report which guides you on investment performance and best fund to invest in. The i-Invest facility was first launched back in August 2019 and sought to allow members to invest their EPF savings into unit trust funds from approved FMIs directly from their EPF i-Akaun portal.

Select Investment on the menu bar. Select Affin Hwang Asset Management Bhd as your fund management institution FMI IPD pick your desired unit trust fund s. You are allowed to invest 30 of the savings amount in excess of your Basic Savings amount required in Account 1.

Click on Investment on the menu bar select Transactions then click Buy. The Benefits of Investing through EPF-MIS How to Invest The amount that can be invested is 30 of the savings in excess of the Basic Savings required in Account 1. Qualified EPF members can choose to invest into EPF-qualified unit trust funds with fund management institutions IPD appointed under the EPF-MIS.

On the buy screen choose your preferred funds. Basic Savings amount is applicable to members up to 55 years. Combined with Eastspring Investments partnership and proven track record of award wins 2 members of EPF have the power to control and monitor their own investments.

All EPF Members above 18 years old can open an investment account. 1 Log in to your EPF i-Akaun 2 Select Investment on the menu bar 3 On the buy screen select Principal then choose your fund s You can start investing with RM1000 4 Select Principal as your preferred Fund Management Institution FMI and complete your transaction Start investing EPFs i-Invest Funds. You basically can just give EPF a call to get the verification code and you can basically go to i-Akaun and register and get the statement.

30 All EPF members are allowed to withdraw and invest 30 of the amount in excess of the required basic savings in Account 1 according to your age ie. Via EPF i-Invest members of EPF may transfer up to 30 of the amount from their EPF Account 1 in excess of basic savings to be invested in funds approved under the EPF-MIS.

Buat Investment Dgn Kwsp Kwsp Ni Selain Kita Boleh Keluarkan Untuk Beli Rumah Dan Buat Haji Kita Jugak Boleh Keluarkan Untuk Buat Investment Ia Investing Smart

Epf I Invest Features You May Not Know About

Investment On Kwsp I Invest The Research Files

Epf Now Lets You Invest In Unit Trust Funds Directly Via I Akaun Portal Soyacincau

A Complete Guide To Epf Members Investment Scheme Best I Invest Fund Youtube

Pelaburan Unit Amanah Islam Kelayakan Skim Pelaburan Ahli Kwsp Untuk Pelaburan Dalam Unit Amanah Unit Trust Islam Sejarah Malaysia

How Epf Digitalising Its Customer Journey

Epf I Invest Features You May Not Know About

Epf I Invest Features You May Not Know About

Celebrating Success How Epf Digitalising Its Customer Journey

Bernama On Twitter Epf I Invest Online Platform Enables Unit Trust Investment Directly From Epf Account Https T Co Ld4hsudysn Https T Co 7aqbflb4dk Twitter

Epf S Enhanced I Invest Facility Allows Easier Access To Funds Screens Members Risk Tolerance

Sponsored This Is Why You Need To Use Epf I Akaun Ringgit Oh Ringgit

Comments

Post a Comment